Essential Documents You Need to Rent an Apartment: Complete 2026 Guide

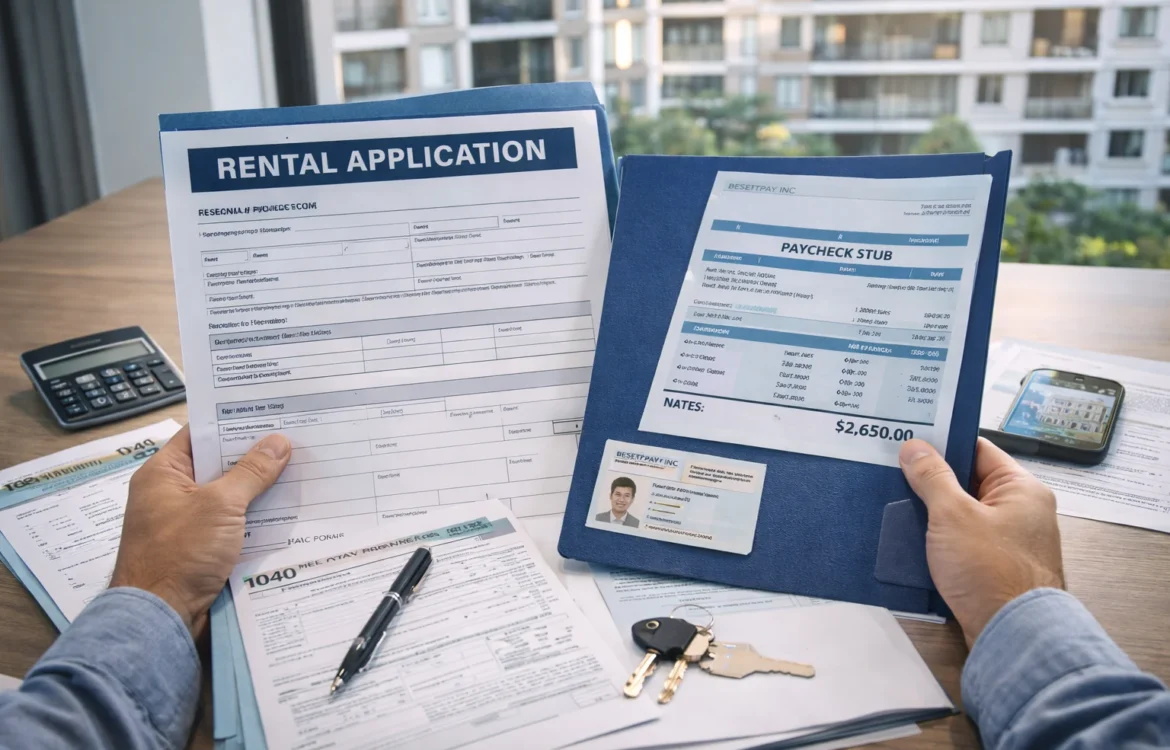

Renting an apartment can be an exciting step, but the application process often feels overwhelming with its extensive paperwork requirements. Landlords and property managers need to verify your identity, financial stability, and rental history to minimize their risk. Having all your documents organized and ready can make the difference between securing your dream apartment and missing out. This comprehensive guide breaks down every document you’ll need, explains why they’re required, and provides tips to streamline your application process. Whether you’re a first-time renter or a seasoned tenant, understanding these apartment requirements will help you prepare effectively and increase your chances of approval.

⚡ Quick Answer

To rent an apartment, you typically need: a government-issued photo ID, proof of income (like recent pay stubs or tax returns), a completed rental application, and a credit report. Additional documents may include rental history references, a security deposit, and sometimes a co-signer agreement. Having these ready speeds up approval and shows you’re a qualified tenant.

Core Documents Every Landlord Requires

When applying for an apartment, certain documents are non-negotiable. Landlords use these to verify your identity and assess your reliability. Missing any of these can delay or derail your application, so gather them first.

- Government-Issued Photo ID: A driver’s license, passport, or state ID confirms your identity and age.

- Completed Rental Application: This form includes personal details, employment history, and references. Many landlords provide a free rental lease agreement template or application form to streamline the process.

- Proof of Income: Documents like recent pay stubs, bank statements, or employment verification letters show you can afford the rent.

- Social Security Number (SSN): Used for credit and background checks, though some landlords may accept an Individual Taxpayer Identification Number (ITIN).

Financial Verification Documents

Landlords prioritize financial stability to ensure timely rent payments. Providing clear proof of income and savings can strengthen your application, especially in competitive rental markets.

- Recent Pay Stubs: Typically, the last 2-3 months’ stubs demonstrate steady employment and income.

- Bank Statements: Showing savings or consistent deposits helps prove financial health. Aim for 3-6 months of statements.

- Tax Returns: For self-employed or freelance renters, the last 1-2 years of tax returns can substitute for pay stubs.

- Employment Verification Letter: A letter from your employer confirming your position, salary, and employment status adds credibility.

Rental History and References

Your past rental behavior is a strong indicator of future reliability. Landlords often contact previous landlords to check for issues like late payments or property damage.

- Previous Landlord References: Contact information for your last 1-2 landlords, ideally with their phone numbers and email addresses.

- Rental Payment History: Proof of on-time payments, such as bank statements or receipts, can offset a weak credit score.

- Eviction History: Be prepared to explain any past evictions. In some cases, providing a rental eviction notice template or related documents might help clarify the situation, though landlords typically conduct their own checks.

Credit and Background Check Materials

Most landlords run credit and background checks to evaluate your financial responsibility and criminal history. While they often handle this themselves, having your own reports ready can speed things up.

| Document Type | Purpose | Common Requirements |

|---|---|---|

| Credit Report | Assess debt, payment history, and credit score | Score of 650+ preferred, but varies by landlord |

| Background Check Authorization | Legal permission to check criminal and rental history | Signed form included in the rental application |

| Proof of Address | Verify current residence | Utility bills or lease agreement from past home |

Additional Documents for Specific Situations

Depending on your circumstances, you might need extra paperwork. For example, students, freelancers, or those with pets often face additional apartment qualifications.

- Co-signer Agreement: If your income or credit is insufficient, a co-signer (like a parent) may need to provide their financial documents and sign a contract.

- Pet Documentation: For pet owners, include vet records, vaccination proof, and a pet resume to show responsibility.

- Student or Visa Documents: International renters might need a visa, I-20 form, or enrollment verification from a school.

- Security Deposit: While not a document, be ready to provide a check or electronic payment. Note that laws like California Civil Code 1950.5 regulate how security deposits are handled, so understanding local rules can prevent disputes.

Tips for Organizing Your Application

A well-organized application package impresses landlords and reduces processing time. Follow these steps to ensure you’re fully prepared.

- Create a Digital Folder: Scan all documents and save them as PDFs for easy email submission.

- Check Specific Requirements: Some landlords or states have unique needs; for instance, using an Indiana lease agreement template might be required in that state, so verify local forms.

- Prepare for Costs: Budget for application fees, which typically range from $25 to $75 per person.

- Follow Up Promptly: Respond quickly to any requests for additional information to keep your application moving forward.

Common Mistakes to Avoid

Even small errors can lead to application rejection. Steer clear of these pitfalls to improve your chances.

- Incomplete Forms: Double-check that every field in the rental application is filled out accurately.

- Outdated Documents: Ensure all financial and ID documents are current (e.g., pay stubs from the last 30 days).

- Poor Communication: Be transparent about any issues, like a low credit score, and provide explanations upfront.

- Ignoring Local Laws: Familiarize yourself with tenant rights in your area to avoid unfair requirements.

FAQs: Documents You Need to Rent an Apartment

What is the most important document for renting an apartment?

Proof of income is often the most critical, as it shows you can afford the rent. Landlords typically require recent pay stubs or tax returns to verify your financial stability.

Can I rent an apartment without a credit check?

Yes, but it’s rare. Some private landlords might skip credit checks if you provide strong proof of income, rental history, or a larger security deposit. However, most property managers insist on it.

How many pay stubs do I need to show?

Usually, 2-3 recent pay stubs are sufficient. If you’re paid biweekly, provide stubs from the last 6-8 weeks to cover a full month’s income.

What if I’m self-employed and don’t have pay stubs?

Use tax returns from the last 1-2 years, bank statements showing regular income deposits, or profit-and-loss statements. An employment verification letter from clients can also help.

Do I need renter’s insurance to apply?

Not always for the application, but many landlords require proof of renter’s insurance before move-in. Check your lease agreement for specific requirements.

What documents do students need to rent an apartment?

Students often need a co-signer agreement, proof of enrollment, and financial aid documents. A parent or guardian may need to provide their income and credit information as well.

Can I use a digital copy of my ID?

Yes, most landlords accept scanned or photographed copies for initial applications. However, you may need to show the physical ID in person before signing the lease.

What happens if I’m missing a document?

Contact the landlord immediately to explain. They might accept alternative documents or give you extra time. Being proactive can prevent your application from being rejected outright.

Leave a Reply